Table of Content

You have to use it as a rental for at least six months to a year first. Similarly, both bills allow people in their early 60s to make larger “catch-up” contributions to their tax-sheltered retirement accounts, $10,000 compared to the current maximum of $6,500. People who have $10,000 of surplus income to place into retirement savings accounts are, by definition, well off and would likely retire comfortably even without such tax breaks. Both bills would allow people to hold their savings in tax-sheltered accounts longer, with no requirement to start taking money out until age 75 .

Three corporate tax cut “extenders” are receiving the most attention in Congress right now and each raises additional concerns. It is not clear right now whether lawmakers will do that – or whether they will enact any tax legislation at all before the year ends. As one year ends and another begins, Thrivent Magazine is here to help you manage financial stress and close out 2022 with some savvy money moves. We offer a wealth of knowledge and resources to help you stay informed and on track to meet your financial goals.

When do you pay capital gains on a home sale?

Many countries offer special tax rates just for collectibles so make sure to consult your tax professional for the correct tax rates in your area. Because the IRS allows exemptions from capital gains taxes only on a principal residence, it’s difficult to avoid capital gains taxes on the sale of a second home without converting that home to your principal residence. Put simply, you can prove that you spent enough time in one home that it qualifies as your principal residence. Also, capital losses from other investments can be used to offset the capital gains from the sale of your home. Large losses can even be carried forward to subsequent tax years. Let’s explore other ways to reduce or avoid capital gains taxes on home sales.

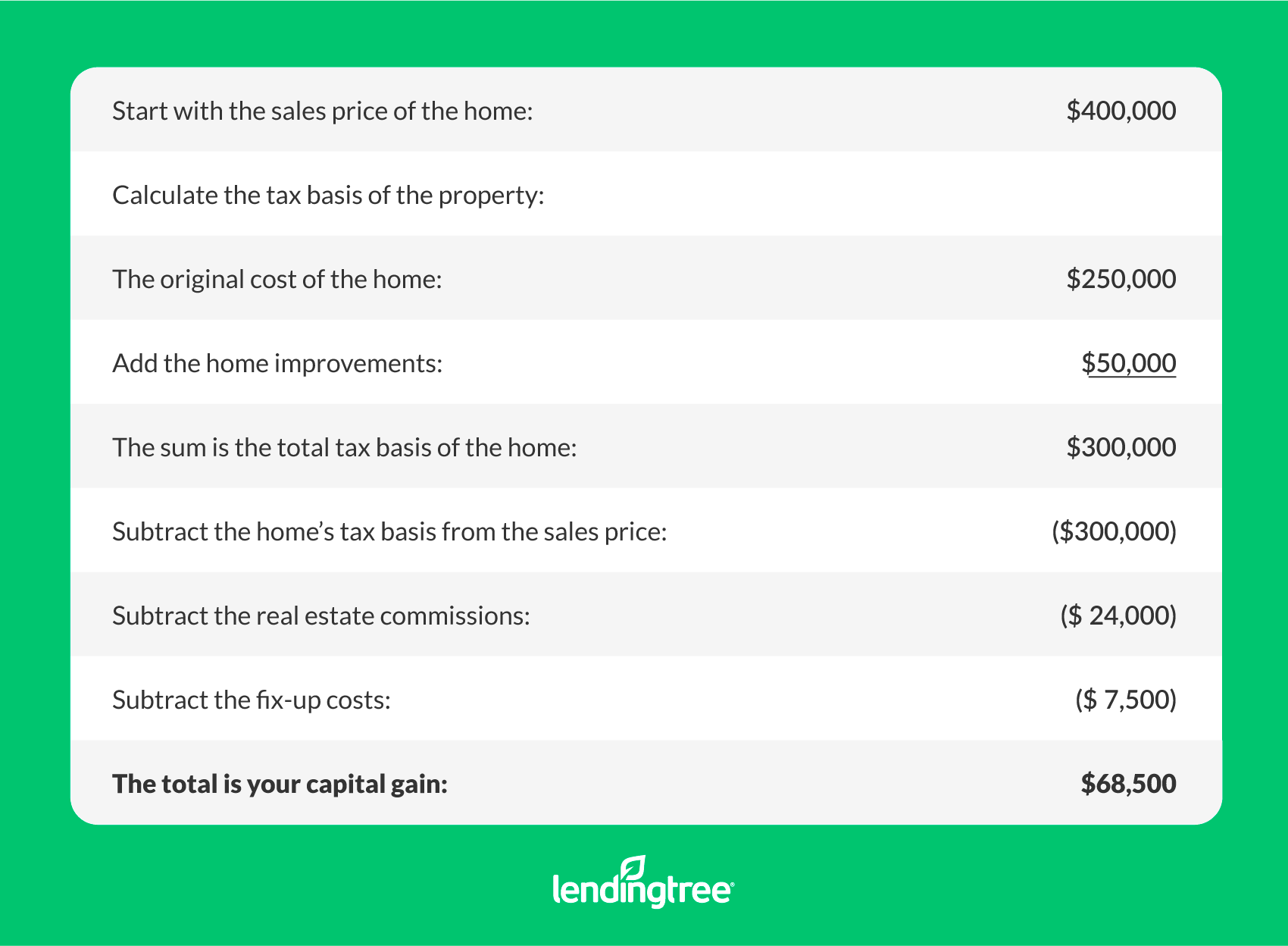

Finally, add your selling costs, like real estate agent commissions and attorney fees, as well as any transfer taxes you incurred. You have non-excludable, taxable gain from the sale of your home (less than $250,000 for single taxpayers and less than $500,000 for married taxpayers filing jointly). How much tax you pay is dependent on the amount of the gain from selling your house and on your tax bracket. If your profits do not exceed the exclusion amount and you meet the IRS guidelines for claiming the exclusion, you owe nothing. If your profits exceed the exclusion amount and you earn $44,625 to $492,300 , you will owe a 15% tax on the profits.

File a claim

If the sales price is $250,000 ($500,000 for married people) or less and the gain is fully excludable from gross income. The homeowner must also affirm that they meet the principal residence requirement. The real estate professional must receive certification that these attestations are true. Homeowners can take advantage of the capital gains tax exclusion when selling a vacation home if they meet the IRS ownership and use rules. But a second home will generally not qualify for a 1031 exchange . The Taxpayer Relief Act of 1997 significantly changed the implications of home sales in a beneficial way for homeowners.

You can carry your 2021 net capital loss back to 2018, 2019, and 2020 and use it to reduce your taxable capital gains in any of these years. When you carry back your net capital loss, you can choose the year to which you apply the loss. If the property you sold was your primary residence , tick the Yes block in the section which asks this question. SARS will then apply the R 2 million primary residence exclusion to the capital gain on assessment. In this example, the R 2 million primary residence exclusion would apply. If your home is sold for a gain (i.e. proceeds minus base cost) that is less than R 2 million, the sale will not attract Capital Gains Tax.

IRS Tax Audit: 20 Triggers!

It is important to realize that tax law changes and personal situations vary so use this calculator as an estimate only and verify all numbers with a competent professional before making any decisions. The property’s sale value is the aggregate of the sales consideration plus certain benefits or receipts that a seller gets. In case there is no full utilization of the proceeds of sale or disposition, the portion of the gain presumed to have been realized from the sale or disposition will be subject to Capital Gains Tax.

You may be able to do so, however, on investment property or rental property. Getting divorced or being transferred because you are military personnel can complicate a taxpayer’s ability to qualify for the use requirement for capital gains tax exclusions on home sales. As a married couple filing jointly, they were able to exclude $500,000 of the capital gains, leaving $200,000 subject to capital gains tax. To be exempt from capital gains tax on the sale of your home, the home must be considered your principal residence based on Internal Revenue Service rules. These rules state that you must have occupied the residence for at least 24 months of the last five years. You could owe capital gains tax if you sell a home that has appreciated in value because it is a capital asset.

How to reflect the sale of your home in your tax return (ITR

If there is an improvement, the FMV, based on the latest tax declaration at the time of the sale or disposition, duly certified by the City/Municipal Assessor shall be used. You must report the sale of a home if you received a Form 1099-S reporting the proceeds from the sale or if there is a non-excludable gain. The FMV is determined on the date of the death of the grantor or on the alternate valuation date if the executor files an estate tax return and elects that method.

Essentially, if you want to hold bitcoin as a long-term investment and you don’t buy and sell frequently, then this would be seen as capital not revenue. But what if you originally used it as your primary residence, but then moved out later and rented it to a tenant? Or, you first rented it out and then used it as your primary residence afterwards? This is the situation many confused taxpayers face, and they want to know how this affects the capital gains tax they need to pay when their property is sold.

If you were to sell it now, the gain would be taxed as ordinary income, and it would add $2,400 to your tax bill. On the other hand, if you wait another month to sell it, it would qualify for the 15% long-term capital gains tax rate, which would reduce your tax hit by $900 to $1,500. In other words, a $7,600 effective gain on the investment would become $8,500. The date of sale or disposition of a property refers to the date of notarization of the document evidencing the transfer of said property. For capital gains over that $250,000-per-person exemption, just how much tax will Uncle Sam take out of your long-term real estate sale?

The AAB receiving the tax return shall stamp mark the word “Received” on the return and also machine validate the return as proof of filing the return and payment of the tax by the taxpayer, respectively. The machine validation shall reflect the date of payment, amount paid and transactions code, the name of the bank, branch code, teller’s code and teller’s initial. Bank debit memo number and date should be indicated in the return for taxpayers paying under the bank debit system.

Let’s look at the same example again but assume now that Paul has never lived in the house that he bought. He rented it to a tenant while he lived in a nearby property with his girlfriend i.e. he bought the house purely as an investment. For example, if you dispose of an asset between 1 January and 30 November, payment is due by 15 December.

You may be exempt from CGT If you dispose of a property you own that you lived in as your only or main residence. Transfers of assets between spouses and civil partners are exempt from Capital Gains Tax. Equity – The value of a property after deduction of charges against it. Depreciation – The reduced value of a property due to wear and tear.

Capital gains tax is often unavoidable when selling a second home but that shouldn’t deter you from your plans if you feel the time is right to sell. Estimating how much you might pay using a capital gains tax calculator can help you develop the right strategy for carrying out the sale while minimizing what you might owe in taxes. No, these are capital costs which cannot be deducted from taxable income.

No comments:

Post a Comment