Table Of Content

- What other investment property or second home property financing options are available?

- I. Public Comments in Response to HUD's October Federal Register Notice

- Pay Down Your Principal

- What is a good credit score for buying a house?

- Property Tax Assessment: What Is It And How Does It Work?

- Access to some of the lowest borrowing rates

- Home Equity Line Of Credit

She was previously at Dow Jones MarketWatch, on the housing market and financial markets beats. Before that, she covered macro and central banks for Investor's Business Daily, and municipal bonds for Debtwire. The borrower receives the entire loan amount upfront—instead of having a line of credit to draw on as needed.

What other investment property or second home property financing options are available?

Mortgage refinance and home equity loan interest rates are typically much lower than interest rates for credit cards, auto loans and personal loans. If you have any of these high-interest debts, you can save big by putting your home’s equity to work. The use of premium pricing may result in HECM for Purchase borrowers being steered into more expensive products that do not meet their long-term financial needs. To determine the best home equity loan rates, we surveyed over 30 home equity lenders. A home equity loan lets you borrow from the equity that you’ve built in your home through mortgage payments and appreciation.

I. Public Comments in Response to HUD's October Federal Register Notice

This means by utilizing a home equity loan, you can avoid the hefty interest rates you would encounter through other forms of financing, like hard money and personal loans. Lenders spend less time originating home equity loans, which may save you money, as it typically means lower fees and closing costs. But perhaps the biggest advantage of this option is the potential to lower your interest rates. With a cash-out refinance, you’ll take out a loan for a higher amount than the balance of your current mortgage. After you have used the funds to pay this off, you’ll have the remainder—minus any closing costs—to use how you see fit.

Pay Down Your Principal

College can be expensive, and student loans aren’t always the lowest-interest way to cover tuition and room and board. You can use your home equity to get cash for tuition or to consolidate your existing student loans into a single, lower-interest loan. For example, say you owe $100,000 on your home, and you believe your home is worth $180,000. A home equity calculator can give you an idea of what your home is worth and how much equity you may have if you’re thinking about selling your home or borrowing a chunk of your equity. The benefit of building equity in your home is both the asset that you build and the ability to borrow money against it.

What is a good credit score for buying a house?

This flexibility can make it an ideal choice if you don’t know exactly how much you’ll need to borrow or if you’re financing a series of projects. A 750 score is considered a "very good" credit score, according to FICO. With a 750 credit score, your mortgage approval odds are good (provided the rest of your finances are strong) and you'll likely get a better rate. Most importantly, you'll want to pay your bills on time each and every month. Your payment history is the factor that has the biggest influence on your credit score.

Property Tax Assessment: What Is It And How Does It Work?

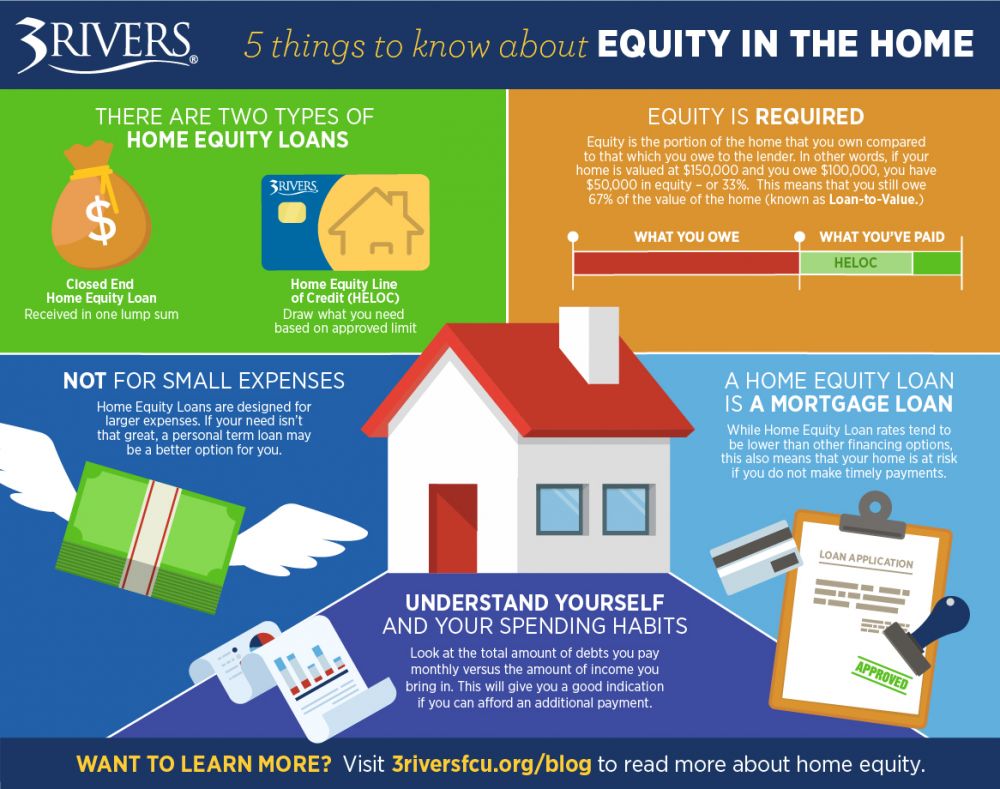

Read on to learn more about home equity loans and other ways to take advantage of your equity to decide if this loan option is right for you. Better known as a HELOC, a home equity line of credit is more like a credit card, but the credit limit is tied to the equity in your home. You can tap into this equity when you sell your current home and move up to a larger, more expensive one.

Be mindful that no matter which method you prefer, your lender may have loan requirements that dictate the method in which your property is appraised when you pursue a home equity loan. A home equity loan is often taken out in the form of a second mortgage. Combine this with the financing you will need for your second home, and it’s likely you will end up with three mortgages for only two properties. The short answer is yes, although the advantages and disadvantages of this course of action may depend on what the second property is used for. It could also be a good option for those interested in buying an investment property. Ideally, the lender wants to see an appraised value that’s equal to or greater than the home equity loan amount.

Using a Home Equity Loan to Buy Land (2024 Guide) - MarketWatch

Using a Home Equity Loan to Buy Land (2024 Guide).

Posted: Thu, 18 Apr 2024 07:00:00 GMT [source]

Should I choose a home equity loan, HELOC, or cash-out refinance?

And rarely do major credit card issuers extend revolving credit limits higher than about $30,000 without the cardholders having stellar credit profiles and high incomes. The debt-to-income (DTI) ratio is a measure of your gross monthly income relative to your monthly debt payments, including your mortgage and home equity loan payments. Qualifying DTI ratios can vary from lender to lender, but, in general, the lower your DTI, the better. Most home equity lenders look for a DTI ratio of no more than 43 percent. Some lenders also extend loans to those with scores below 620, but these lenders might require you to have more equity or carry less debt relative to your income. Bad credit home equity loans and HELOCs could come with higher interest rates, limited loan amounts and shorter repayment periods.

Home Equity Line Of Credit

As you make mortgage payments on the property and its value appreciates with time, the share of the home that you actually own — your equity — grows. By taking out a home equity loan, you convert that equity back into debt in exchange for cash. On the downside, you will have to pay closing costs—between 2% to 5% of the total loan amount. Interest also accrues on the entire loan amount and shrinks how much equity you have in your home. A home equity loan can also be risky if your local housing market craters and you end up owing more than your home is worth. You will also have to pay the entire outstanding balance if you choose to sell your home.

Your DTI ratio shows how much of your monthly income goes towards covering your existing debt obligations. It helps lenders determine whether you can afford to take on more debt. To qualify for a home equity loan, typically your DTI cannot be higher than 43%. Ashley was a deputy editor for loans and mortgages at Forbes Advisor.

If you want to obtain a home equity loan, a higher credit score will give you more flexibility on terms. For example, higher scores may allow you to access more of your equity. Home equity loans are often called second mortgages because you have another loan payment to make on top of your primary mortgage.

Getting a home equity loan instead — a simpler, if slightly more expensive type of financing — might be the better choice. Loan details presented here are current as of the publication date, but definitely check the lenders’ websites to see if there is more recent information. Our advertisers do not compensate us for favorable reviews or recommendations. Our site has comprehensive free listings and information for a variety of financial services from mortgages to banking to insurance, but we don’t include every product in the marketplace. In addition, though we strive to make our listings as current as possible, check with the individual providers for the latest information.

Like a home equity loan, missing your HELOC payments puts you at risk of losing your home. Home equity is calculated by subtracting how much you owe on all loans secured by your house from your home's appraised value. It is the residual value of your home after all liabilities related to the home have been deducted. Potential lenders use the LTV to determine whether or not to approve your applications for additional loans.

The fair market value of your home simply refers to what a homebuyer would likely pay for the property today. Personal loans typically have higher rates than home equity loans, because they aren’t backed by an asset. They’re also less risky, since home equity loans carry the danger of losing your home to foreclosure if you can’t make required payments. See the pros and cons of a home equity loan versus a personal loan. Lenders also consider your debt-to-income ratio — the percentage of your monthly gross income that goes towards paying debts — when determining your rate offer.

No comments:

Post a Comment